Accounting Standards Are Best Described as

Ideal standards are standards that do not allow for normal wastage and work interruption due to breakdown of machinery employees rest periods. The result of a political process among groups with diverse interests presentation standards mandated by the Securities and Exchange Commission the state-of-the-art presentation of the science of accounting measuring the quality of safeguarding assets.

/paper-with-title-international-financial-reporting-standards--ifrs---850740234-6e303822ed5e4800b523b0ac24db396c.jpg)

International Accounting Standards Ias

The role of the Securities and Exchange Commission SEC in the formulation of accounting standards can be best described as A.

. They do so by standardizing accounting policies and principles of a nation economy. The role of the Securities and Exchange Commission SEC in the formulation of accounting standards can be best described as varied the SEC relies on FASB to develop standards but gives advice and recommendations to the private sector as needed. The meaning of Present fairly in accordance with generally accepted accounting principles The objectives and concepts for use in developing standards of financial accounting and reporting.

Accounting Standards can be described as a vehicle whereby the wisdom and experience of the profession emerges as a consensus in a complex and changing economic and business situation in preference to the views of individual compilers of financial statements. These accounting standards have been prepared to meet the needs of the international financial industry for standardised accounting reporting that can be relied on for uniform presentation of information. It is a global phenomenon intended to bring about transparency and a higher degree of.

In Accounting Standard 9 of Companies Accounting Standards Rules ASI 14 is incorporated in AS 9 Revenue Recognition as an explanation below para 10 as follows. Accounting standards are best described as a the 25. The state-of-the-art presentation of the science of accounting.

Choose the letter of the best answer. Added text is underlined and. It allows the FASB to develop all accounting standards by itself.

The result of a political process among groups with diverse interests. Accounting Standards AS are basic policy documents. The GAAP accounting standards have been largely developed within the United States while the IFRS accounting standards are more European based.

Terms from the Master Glossary are in bold type. In May 2014 the IASB and FASB issued converged accounting standards which aim to provide a principles-based approach to revenue recognition. T o pr ovide information that the cred itors of an economic entity can u se in.

The role of the Securities and Exchange Commission SEC in the formulation of accounting standards can be best described as a varied - the SEC relies on FASB to develop standards but gives advice and recommendations to the private sector as needed. In some cases to put the change in context not only are the amended paragraphs shown but also the preceding and following paragraphs. It develops all accounting.

Concepts such as relevance reliability materiality and comparability are often supported by accounting conventions that. Accounting is full of assumptions concepts standards and conventions. The role of the Securities and Exchange Commission SEC in the formulation of accounting standards can be best described as1.

Control its op erations. Accounting Standards are best described as. Accounting acct1 BS Accountancy IT 101 Accountancy BSA Accountancy Intermediate accounting ACC 205 Accountancy ACTG01 Accountancy a Accountancy Bsa1 Cost Accounting and Control ACC 3107 Accountancy BS Education BS Education Accountancy BA112 Science Technology and Society STS 313 Bachelor of Science in Accountancy BSA.

The general concept is to factor in the. Varied - SEC relies on FASB to develop standards but gives advice and recommendations to the private sector as needed D. It develops all accounting standards by itself B.

It allows the FASB to develop all accounting standards by itself2. The Accounting Standards Codification is amended as described in paragraphs 220. Establish accounting standards for multinational entities d.

In a standard costing system standards are normally categorized as ideal standards and practical standardsThe difference between these two types of standards is briefly explained below. List of Accounting Standards of ICAI. It develops all accounting standards by itself.

The first step taken in the establishment of a typical FASB statement is. It allows the FASB to develop all accounting standards by itself C. The basic objective of accounting is.

T o pr ovide the inform ation that the managers of an economic entity need to. Which of the following statements best describes generally accepted accounting principles. Generally accepted accounting principles in financial reporting by business enterprises.

In cases where revenue cycle of the entity involves collection of excise duty the enterprise is required to disclose revenue at gross as reduced by excise amount thereby finally arriving at net sales on the face of the. Their main aim is to ensure transparency reliability consistency and comparability of the financial statements. Develop accounting standards for countries that do not have their own standard-setting bodies 10.

C it allows the FASB to develop all accounting standards by itself. The core principle behind these converged standards is that revenue is to be recognized in order to depict the transfer of promised goods or services to customers in an amount that reflects the. Presentation standards mandated by the Securities and Exchange Commission.

Accounting Standards are best described as. Accounting Standards Board FASB an independent non-governmental organization with crafting and maintaining the Generally Accepted Accounting Principles GAAP rules and guidelines that govern. Accounting conservatism is a set of bookkeeping guidelines that call for a high degree of verification before a company can make a legal claim to any profit.

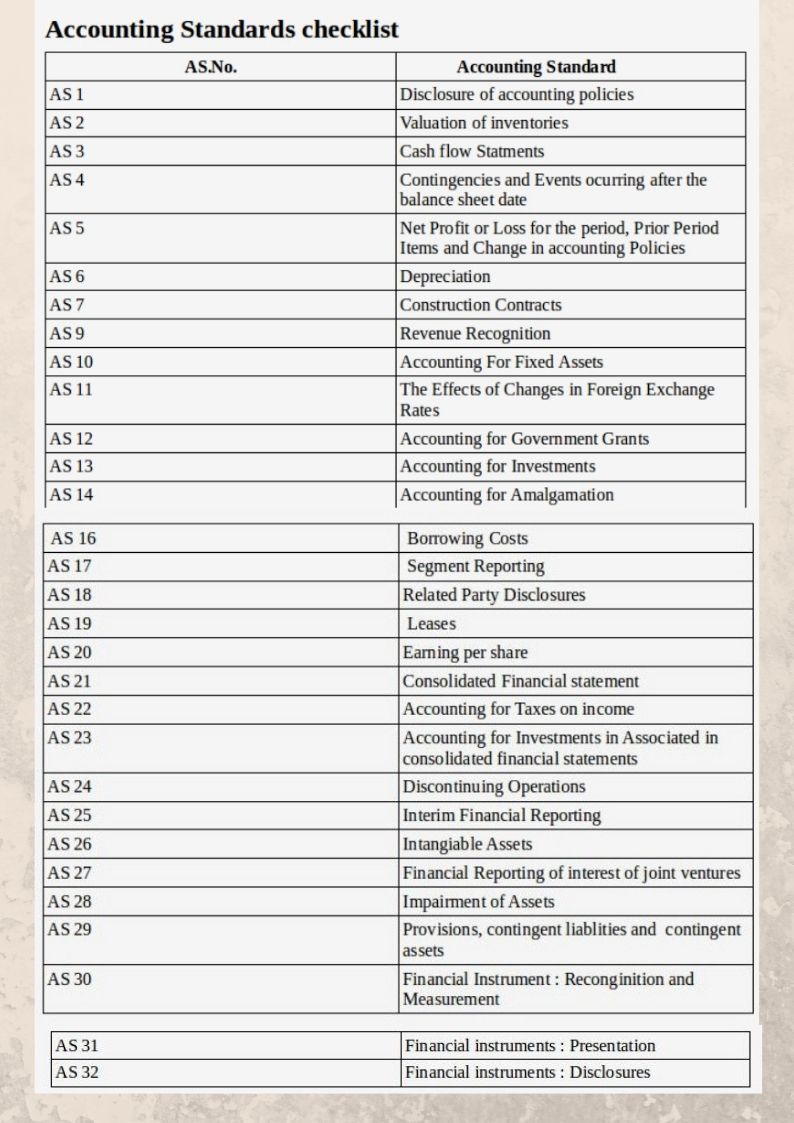

The role of the Securities and Exchange Commission SEC in the formulation of accounting standards can be best described as a. AS-1 to AS-32 updated 01022022 In India the Accounting Standards for non-corporate entities including Small and Medium sized Enterprises SMEs are issued by the Accounting Standards Board ASB of ICAI to establish uniform standards for preparation of financial statements in accordance with the Indian GAAP. There is an increasing.

Deciding whether to mak e additional loans to the entity. Varied - the SEC relies on FASB to develop standards but gives advice and recommendations to the private sector as needed3.

Accounting Standard Overview History Examples

Accounting Standards Meaning Features And Merits Legalraasta

No comments for "Accounting Standards Are Best Described as"

Post a Comment